- Brazil’s second corn crop harvest is progressing slower than normal due to rain.

- The impact of frosts on the corn crop has proven minimal this year.

- Export levels have been reported as surprisingly slow for July.

- Domestic corn demand is solid but needs export support to avoid price drops.

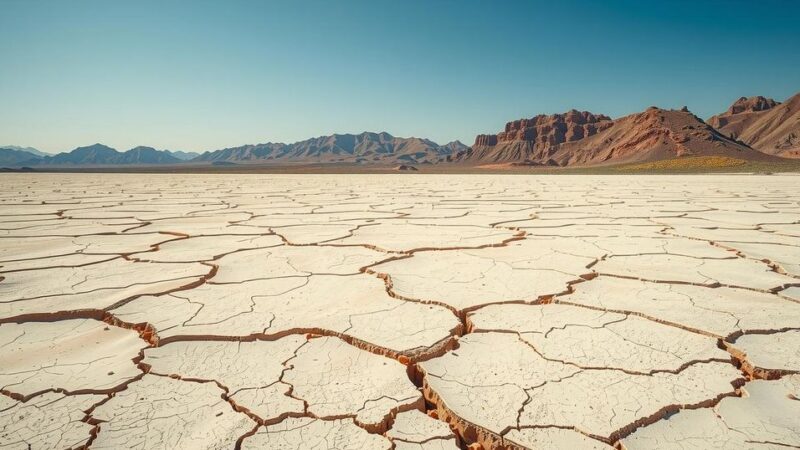

- Rains have raised concerns about crop quality and prolonged harvest periods.

Weather Conditions Impacting Corn Harvest in Brazil

Delayed harvest conditions are hindering the second corn crop in Brazil, with unusual weather patterns, particularly the rainy fall leading into winter. Despite this, it’s noteworthy that frosts from last week didn’t have a significant impact as the crop was past a critical growth stage. Regional crops that had just emerged may have suffered mild damage, but that, in the bigger picture, seems manageable since quality issues could arise in the warehouses in affected areas. Additionally, while export levels hold steady, the slow pace adds extra strain to the domestic market needing liquidity, emphasizing the urgent need for a balance in export flows in the upcoming months.

Intensification Lacking Due to Delays and Rains

The second crop harvest is ramping up in regions like Mato Grosso and Matopiba, fulfilling local demand as the first harvests are underway. In Goiás, recent rains are expected to help accelerate the pace of harvesting. Meanwhile, Minas Gerais and São Paulo are just beginning with sorghum, while the main corn harvest in those areas will likely kick off around mid-July. However, constant rains in places like Paraná, Paraguay, and Mato Grosso do Sul have extended the harvest timeline considerably, which raises concerns regarding moisture and potential quality degradation for some hybrids. Northern states, particularly Santa Catarina and Pará, appear to be leading with quicker harvesting progress despite facing a few logistical challenges.

Concerns for Export Flow and Domestic Prices

Shifting focus to the implications of domestic markets, there’s a pressing question regarding the influx of harvest volumes—about 100 million tons expected in the market soon—and how local prices will behave in response. Present domestic demand seems solid, but without sufficient export flow, the situation could become challenging in the coming months. This month, there have been reported weak shipment schedules for June, with only 650 thousand tons lined up as ships transition toward July schedules. Comparatively speaking, next month’s expected shipments of 1.6 million tons fall far short of the previous year’s 3.6 million ship load for the same time. A synergy between domestic demand and export flow will be critical to prevent a price slide that could affect market sustainability in the coming semester.

Market Pressures and Future Demand for Corn

The corn market dynamics remain tense, especially with the ongoing fluctuation in prices seen at the Chicago Board of Trade (CBOT), where prices dipped to $4.00 per bushel recently. Domestically, port prices are fluctuating between BRL 63 and 66 per bag. The market will likely face greater selling pressures in July and August, leading to more shipments concentrated in August and January to keep the second crop’s flow stable. Another crucial factor here, as noted previously, is the planned increase in ethanol’s share in gasoline—which aims to go from 27.5% to 30%. In a short-term scenario, corn accumulation in this segment isn’t projected to grow, as the current plants are already operating at maximum capacity. Thus, new facilities will be critical for any increased demand in the coming years, while sugarcane fields are expected to pivot successfully to bolster ethanol production.

In summary, Brazil’s corn harvest is lagging due to rain and weather conditions, but internal demand remains favorable. With export flows lacking, market dynamics could shift significantly, impacting prices in the upcoming months. Stakeholders must prepare for upcoming shipment challenges and potential quality issues as harvest conditions continue to evolve.