The Saudi stock market fell 0.6%, affected by disappointing earnings and declining bank shares. In contrast, Egypt’s EGX30 rose 0.8%, fueled by strong results from key companies. Economic indicators, like the rise in Egypt’s money supply, added to positive investor sentiment, while oil price declines affected wider market conditions.

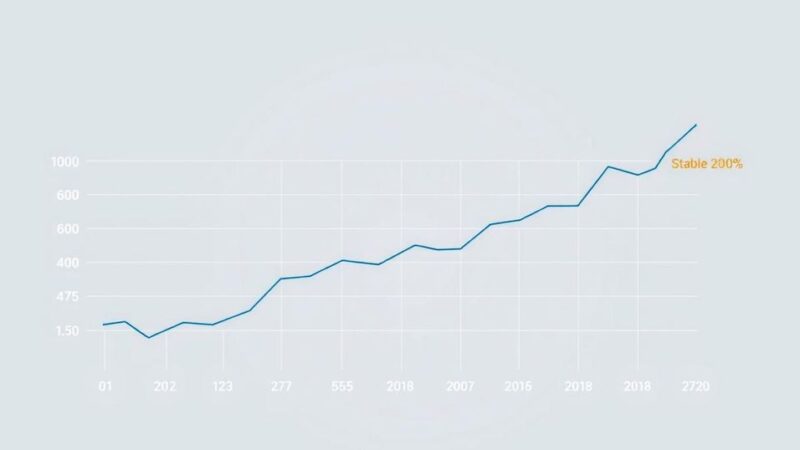

The Saudi stock market closed lower on Sunday, marking the fourth consecutive session of losses, primarily due to disappointing corporate earnings. The benchmark index, TASI, fell by 0.6%, influenced by a 0.4% drop in Al Rajhi Bank and a notable 3.4% decline in Riyad Bank’s shares. Additionally, the Saudi Tadawul Group saw a decrease of 0.5%, as its annual profit missed analysts’ expectations.

Oil prices experienced a decline last Friday amidst political tensions involving the U.S. and Ukraine, compounded by uncertainties surrounding new tariffs from Washington and Iraq’s decision to resume oil exports from the Kurdistan region. This market sentiment contributed to the downward trend observed in the Saudi stock market.

Conversely, Egypt’s blue-chip index, EGX30, rose by 0.8%, breaking a four-day losing streak. Key banking stock Commercial International Bank increased by 1.1%, while Fawry for Banking Technology surged by 4.4%, driven by positive profit forecasts for 2024. E-Finance for Digital and Financial Investments also reported a significant 2.7% increase in its share price following a notable rise in its fourth-quarter profit.

Central bank data revealed that Egypt’s M2 money supply grew by 32.1% year-on-year in January, further fueling investor confidence in the Egyptian market. The bullish performance in Egypt stands in contrast to the struggles in Saudi Arabia’s market, representing a divergence in regional economic sentiment.

Market performance in the Gulf Cooperation Council (GCC) was mixed, with Bahrain’s BHBX gaining 0.6%, Oman’s index rising 0.1%, and Kuwait’s index increasing by 0.5%. It is noteworthy that Qatar’s stock market was closed for a public holiday, further contributing to fluctuations in the regional market activity.

In summary, the Saudi stock market faced continued declines due to lackluster corporate earnings, impacted by falling bank stocks and external market pressures. Meanwhile, Egypt experienced gains driven by strong company results and healthy economic data regarding money supply. The disparity between the two markets emphasizes differing investor sentiments in the region, influencing market performance significantly.

Original Source: www.tradingview.com