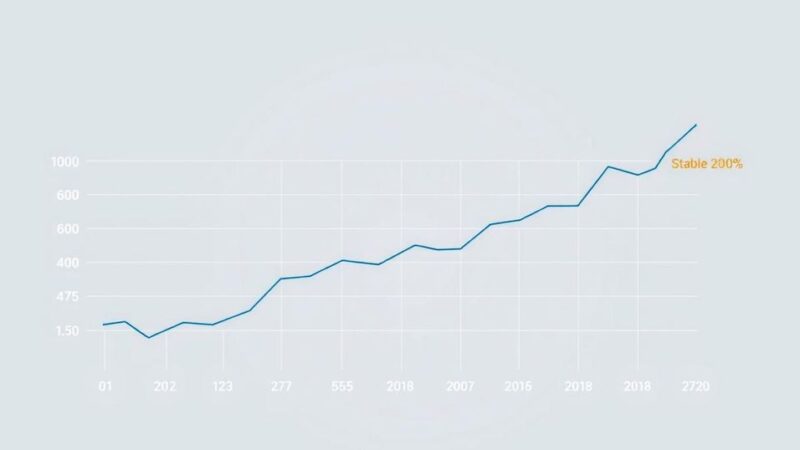

The Brazilian real is stable at around 5.8 per USD, following improved inflation data indicating a 4.96% rate, which alleviates concerns over price pressures. Persistent underlying inflation still supports high interest rates, aiding carry trades. However, potential tariffs from the U.S. could challenge Brazil’s export-driven economy, affecting currency demand.

The Brazilian real remains stable at approximately 5.8 per USD, showing a pause in its recovery from an all-time low of 6.29 that occurred on December 18. This stability follows the release of new inflation data, which has eased concerns regarding uncontrolled inflation and the potential necessity for stringent monetary policy measures.

Recent mid-month inflation statistics indicate an annual headline rate of 4.96%, slightly lower than forecasts. This development suggests a less severe inflation environment than anticipated, potentially reducing the urgency for the Brazilian central bank to implement aggressive policy adjustments in the near term.

However, persistent core inflation suggests that Brazil’s central bank may forecast sustained high interest rates as essential. This situation underpins the country’s attractive interest rate differential for carry trades, leading to an increased demand for the Brazilian real in foreign exchange markets.

Conversely, potential trade tariffs from President Trump, if put into action, may negatively impact global trade dynamics and strain Brazil’s export-reliant economy. Such developments could diminish investor appetite for the real, introducing additional risks to its value against other currencies.

In conclusion, the Brazilian real is maintaining its position thanks to improved inflation data, suggesting less severe price pressures than previously feared. However, ongoing inflation and potential trade tensions may still influence its market stability. Investors are advised to monitor these factors closely as they may affect the Brazilian economy and the attractiveness of its currency in the international market.

Original Source: www.tradingview.com