President Javier Milei of Argentina launched the LIBRA meme coin, initially achieving a market cap of $4.5 billion before crashing by 87%. Analysts raised concerns over the project’s legitimacy, citing potential pump-and-dump activity and centralized control of the token’s supply. Despite an intention to stimulate local businesses, its rapid decline has attracted skepticism and scrutiny.

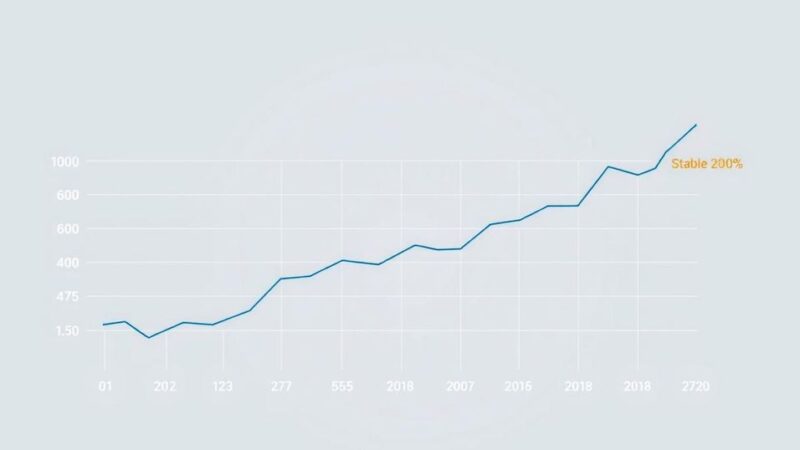

Argentina’s President Javier Milei promoted a meme coin called LIBRA on X (formerly Twitter), leading to a rapid spike in purchases and a market cap of approximately $4.5 billion. However, the LIBRA coin faced skepticism about its legitimacy, resulting in a dramatic price drop of about 87% shortly after its launch. Initially priced at $4.50, it has now plummeted to under $0.60 despite accruing a trading volume of about $1.1 billion within hours.

The project, according to its website, is intended to stimulate the Argentine economy by funding local businesses and initiatives. A post on Milei’s account states, “This private project will be dedicated to encouraging the growth of the Argentine economy by funding small Argentine businesses and startups.” The message emphasizes global interest in investing in Argentina.

The LIBRA launch drew parallels to the TRUMP token launch by former U.S. President Donald Trump shortly before his inauguration. Both instances saw traders eagerly investing in the meme coins, only to later express doubts about their authenticity. While Trump’s coin ultimately proved valid, concerns remain regarding the launch of LIBRA.

On-chain analytics firm Chainalysis identified several potential issues with LIBRA, such as the initial funding coming from an instant swap service and a large supply being managed by a single wallet. This setup raises alarms since reputable token launches typically involve more secure multi-signature setups.

Bubblemaps, an on-chain data visualization firm, claimed the LIBRA development team is profiting from the situation, alleging they have already withdrawn $87 million from liquidity pools. “LIBRA is down 85% because the devs absorbed $87M of buy pressure into their pockets,” the firm noted, pointing to a troubling trend in the coin’s valuation.

The launch of Argentina’s LIBRA coin has raised significant concerns among investors regarding its legitimacy. Despite initial excitement and a substantial market cap, the coin’s dramatic price collapse signals potential irregularities. Skepticism is fueled by the concentration of control among a small number of wallets and the possibility of a scheme benefiting developers at the expense of investors.

Original Source: decrypt.co